CityFALCON Fundraise Interest

Claim a stake in the Future of Financial Content from £50

Powered by

Private investment 100% matched by UK Future Fund (subject to approval)

KEY FINANCIAL INFORMATION

- A top-up round coupled with the Future Fund, wherein the UK government matches private investment pound-for-pound

- 2 six-figure grants from Malta Enterprise (ME) for operations costs in Malta, and collaboration with the University of Malta, subject to T&Cs

- ME grants are non-refundable, non-taxable, and non-equity-dilutive

- Only one share class with voting rights for investors, employees, and founders

- Less than £100k in debt prior to the round. If this round's investment is converted, it will convert to the same share class as all other equity stakeholders

WHAT YOU GET FOR YOUR INVESTMENT

Your investment will be part of a convertible loan note (CLN), which has the downside protection of debt and the upside benefit of equity. If the company enters a distress sale, debt holders are first in line for the proceeds, while if the company succeeds, investors can convert their debt into equity to reap much more reward through capital appreciation than loan interest.

The terms are as follows: 8% simple annual interest, 36 months maturity, 100% redemption if not converted, and a 20% discount to the valuation upon conversion, subject to the valuation cap.

Moreover, the UK Future Fund will match private investment pound-for-pound, so our runway is extended even further.

Convertible debt can be a little confusing, so see this Seedrs post on convertible debt for more details, including more information on the Future Fund.

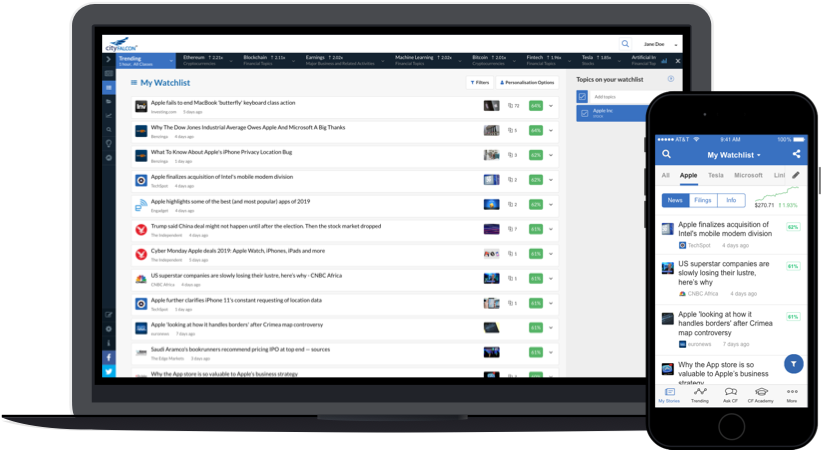

ONE PLATFORM FOR ALL YOUR DUE DILIGENCE NEEDS

We are building CityFALCON into the only platform you’ll ever need for thorough, precise, and convenient due diligence

WHAT ARE WE WILLING TO DO TO SUCCEED?

Whatever it takes - even pitching from an ice hole for 3 minutes!

OUR CUSTOMERS MAKE OUR COMPANY POSSIBLE!

Financial institutions, startups, and tens of thousands of individuals trust CityFALCON to provide top-tier, quality content for their investing and business information needs.

.png)

.png)

.png)

.png)

.png)

THE PROBLEM: A LACK OF ACCESS

High Costs

High Costs

Up to £24,000 per annum for incumbent platforms

Poor User Experience

Poor User Experience

The 1990s onboarding experience

Information Overload

Information Overload

For popular topics

No Information

No Information

For the long tail of topics

Underserved Audiences

Underserved Audiences

A focus on wealthy traders and investors leave some audiences behind:

- Retail Investors and Traders

- Wealth Managers

- Fintechs and Other Startups

- Small and Medium Enterprises

- Knowledge Management Teams

THE CITYFALCON SOLUTION – THE NEXT GENERATION OF FINANCIAL CONTENT

Low Price and significant value of Revolut

Low Price and significant value of Revolut

Natural language processing (NLP) and machine learning automate operations to keep costs low

Personalisation of Spotify and Netflix

Personalisation of Spotify and Netflix

Content adapts to the target audience using proprietary CityFALCON Score and machine learning

Beyond data: automated insights and analysis

Beyond data: automated insights and analysis

Spend more time making decisions and less time reading and researching

No paywalls, no clutter

No paywalls, no clutter

Full texts of paywalled and non-public content from 225+ publications, including The Washington Post, Fitch, and The Economist

Intuitive user experience of Spotify and Revolut

Intuitive user experience of Spotify and Revolut

Register and use - no need for training. Optimal for busy Millennials and Gen Z

Financial content coverage and search capabilities beyond Google

Financial content coverage and search capabilities beyond Google

- 300,000 topics, 200 million by end 2021

- News from 5000+ sources, tweets, filings with regulators and companies houses, sentiment analysis, alternative data, summarisation, and more

- 30+ languages (90+ through R&D project, coming online in 2021-22)

.png)

CITYFALCON’S 7 KEY DIFFERENTIATORS

Next Generation

Next Generation

Embracing the trend of intuitive platforms for the next generation of tech-savvy market participants

Fair Price

Fair Price

Reasonably priced, affordable for everyone

Non-English Coverage

Non-English Coverage

The world speaks more than English. Content in 30+ languages, expanding to 90+ through our R&D project in Malta, provides a window into local events before they’re global

Long Tail Coverage

Long Tail Coverage

Content on even obscure and niche public and private companies to drive a one-stop-shop for every investor or trader

Automated

Automated

No one at the office? No problem. Automation runs the whole operation

Lean

Lean

Lean methodology and strict cash flow management reduces the startup failure risk

Unrestricted Data

Unrestricted Data

We share our data via API to the extent possible

Privacy

Privacy

Unlike Google, Yahoo Finance, and others, we don't sell your data to advertisers, instead charging a small subscription fee to finance our costs

SEAMLESS, ELEGANT INTEGRATION ON CLIENT PLATFORMS...

Any content provider can whitelabel and integrate our data within hours

THE PEOPLE MAKING IT POSSIBLE

From a one-man operation in the dream stage to nearly 40 employees with offices in London, Malta, and Ukraine

COLLABORATION WITH 2 UNIVERSITIES

University of Malta and Saints Cyril and Methodius University of Skopje

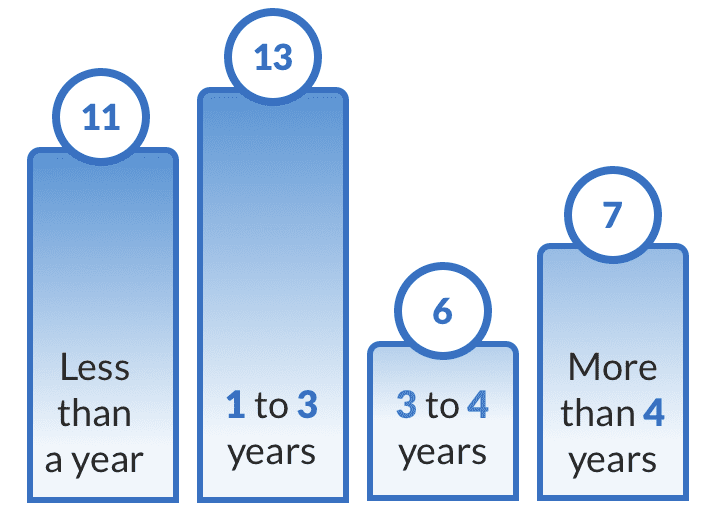

YEARS WORKING TOGETHER

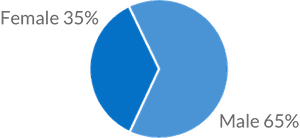

STRONG GENDER RATIO IN TECH

MULTIBILLION DOLLAR MARKET TO DISRUPT

In finance, data is money and the new oil, powering modern economies and driving growth. Quality, curated, structured data is a lot of money!

Read an article about the market size here.

.png)

Source: Burton-Taylor International Consulting LLC

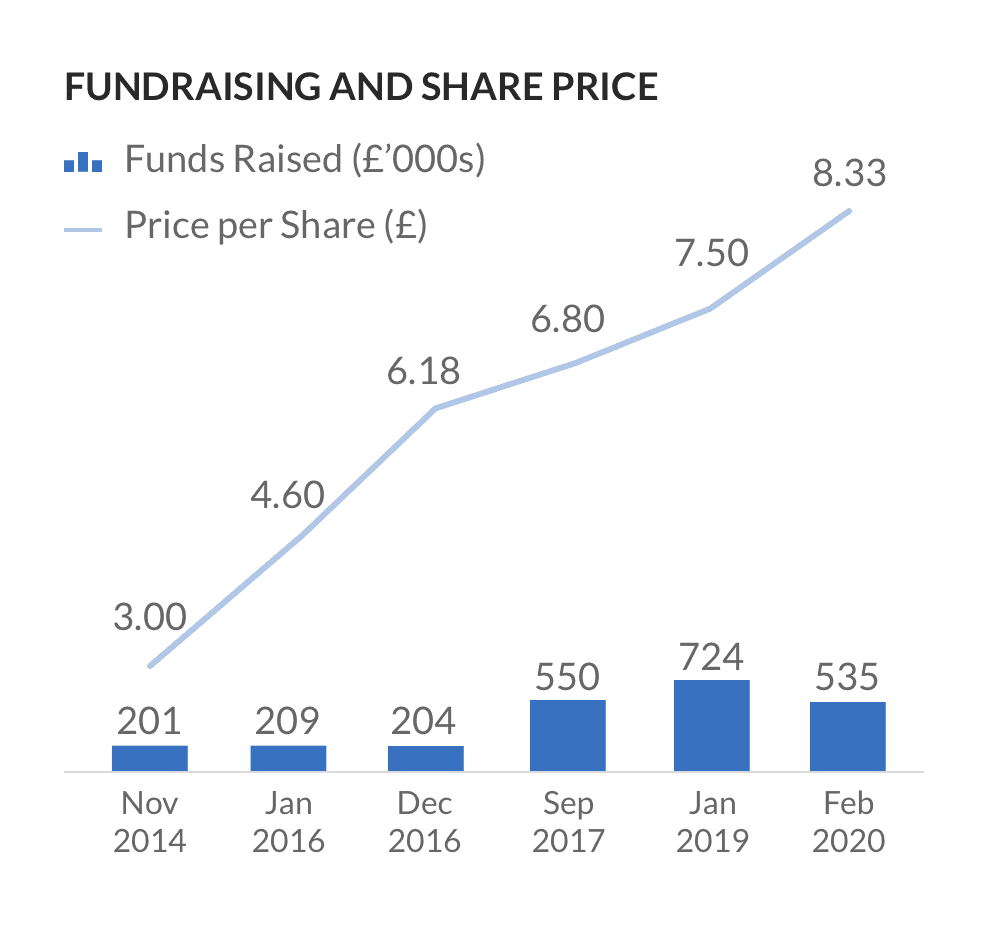

OUR JOURNEY UNTIL NOW

Needing a solution for his lack of access to quality data and real-time content while investing, our founder built a basic version of our product from his bedroom in 2014. This need grew into a passion which blossomed into CityFALCON.

Originally we envisioned a simple, personalised financial news service. Since then, we’ve broadened our horizons by leveraging the latest technology to deliver relevant content in milliseconds, provide analytics-based insights, and offer an intuitive user experience. The Spotify concept best encapsulates our platform.

FEATURED IN

MEMBER OF / ALUM OF

.png)

.png)

BUSINESS MODEL AND REVENUE STREAMS

MONTHLY RECURRING STREAMS

RETAIL SUBSCRIPTIONS

- Sentiment analysis, spam detection, full-text access to select paywalled and non-public content, analytics, insights, and more

- Freemium model – free to try and two premium subscription tiers

REAL-TIME API PLANS

- Structured, machine-readable content to integrate into client platforms or algorithmic trading

- Subscription plans with API call limits and tier-separated features

INSIGHTS AND ANALYSIS

- Insights for asset classes, securities, locations, or people

- Two-tiered monthly pricing

ONE-TIME OR RECURRING

HISTORICAL DATASETS

- Historical data stretching back 5 years for research or back testing

- Purchasable as bulk data with considerable customisation options

PAY PER VIEW

- One-time reading of Premium content with redeemable tokens

- All CityFALCON features unlocked for a 24 or 48 hour period

YOUR RETURN ON INVESTMENT

We believe in financial efficiency and question every penny we spend. We do NOT believe in the Silicon Valley tradition of burning cash to acquire users without seeing a clear monetary return.

Our first target remains to become cash flow positive, and then scale the business to become a multi-billion-dollar company.

Join us on our journey. Reshape the future of financial data distribution and enjoy capital gains along the way.

CityFALCON Way

Financial efficiency

Question every penny spent

Be sustainable

Silicon Valley Way

Burn cash to acquire users

Blow millions in months

Go bankrupt

>£1,000

3 months

Gold subscription

£45 value

>£5,000

6 months

Gold subscription

£85 value

OR

50% discount on Business Starter API plan for 1 year

£960 value

>£10,000

1 year

Gold subscription

£145 value

OR

50% discount on Business Starter API plan for 1 year

£730 value

Plus for non-EIS only

5 night stay in Malta in shared company apartment plus coworking space

£250 value

Total value: £395 - 980

>£20,000

2 years

Gold subscription

£260 value

OR

50% discount on Business Starter API plan for 2 years

£1460 value

Plus for non-EIS only

10 night stay in Malta in shared company apartment plus coworking space

£500 value

Total value: £760 - 1,960

FREQUENTLY ASKED QUESTIONS

Is signing up via the form above a commitment to invest?

No, it's not a commitment, it just helps us to understand the interest and plan our campaign.

Will I get more information about the company and the investment terms?

Yes, when the investment round is opened, we'll share more info with everyone.

What will the money raised be used for?

We'll use the money to continue building our scalable products, market our offerings, and sell to businesses. We want to break even and become self -sustainable as soon as possible.

How do you keep investors informed?

We send monthly emails regarding the latest developments in the company, a short-term outlook, and what to expect in the coming months.

Can I sell shares that I buy?

You will not receive shares in this round but convertible debt. You will not be able to trade the debt. If the debt is converted to equity, you are free to sell your shares. However, we may not be listed on any public exchanges, and you would have to sell your shares privately or through a semi-private exchange. Liquidity is low in such markets and you may find it difficult to sell shares until we are listed on an active public exchange.

From which countries can you accept investment?

You can be resident in any country and invest. However, all investment activity through our crowdfunding platform, Seedrs, takes place in the United Kingdom. It is up to the investor to ensure s/he is compliant with local regulations before investing via a UK entity.

Will I get any interest or dividend?

Because this round is through a convertible loan note (CLN), you will receive 8% simple (non-compounding) annual interest on your investment. If the debt converts, you are entitled to receive that 8% interest in the equity. If the debt is not converted, you are entitled to receive a 100% redemption premium at the end of the 36 months maturity period plus accumulated interest.

There is no dividend associated with this instrument, and even upon conversion, we do not expect dividends for equity in the medium term.

For how long will my money be locked?

The maturity of the debt is 36 months, at which point it will enter repayment if there is no conversion. However, it may be converted before then. If it is converted, then you will become an equity shareholder and are free to sell your shares whenever you wish. The market may be illiquid and it may be difficult to sell shares though.

Who will perform due diligence on the information you provide?

As a private company, we do not make our financial statements public. However, Seedrs will perform their own due diligence, as they do on other offerings on their platform, to ensure our company is not fraudulent and that we are not hiding any problems or issues from investors.

What is the minimum and maximum investment amount?

The minimum amount for this round is £50. There is no maximum amount.

How do I get access to more information about the company and team?

You can find more information through our Seedrs campaign. You may also contact our finance team with specific questions.

Join our next equity crowdfunding campaign from £50. Express your interest here.

Completing this form does not bind or commit you to anything. We use the information to plan our next round of fundraising.

Investment Interest

DISCLAIMER

- CityFALCON will never distribute unsolicited emails, and you can remove yourself from our contact list by unsubscribing at any time.

- Capital at risk. Investing in start-up and early stage companies involves risks, including loss of any initial investment and any reward, and it should be done only as part of a diversified portfolio. Please check with your investment advisor.

- CityFALCON is not associated with any brands mentioned on this page.

- There is no guarantee of investment appreciation. There is a risk of losing your entire investment.

- A small percentage of startups succeed, and we believe our current team, achievements to date, and client traction give us a 50% chance of becoming cash flow positive.

- Investment via Seedrs permits trading on Seedrs secondary market at any time, subject to liquidity

- Past performance may not be indicative of future results.