Twitter, and The Importance of Financial Tweets and News

to Investors and Traders

.png)

Twitter is a multibillion dollar company that enables its users to broadcast short (140-280 characters) messages about whatever they feel like, reaching a potential audience of 330 million active users (as of Q4 2017). Messages are broadcast in real time, so developing stories can be updated instantly and continuously by those closest to the source of the event.

This far reach, instantaneous updates, and small message size makes Twitter ideal as a source of compact news for consumers and as a platform for those wanting to make announcements, like companies, politicians, and your next door neighbour.

Twitter as a Broadcast Platform

Twitter not only allows the user to reach hundreds of millions of potential active users, those active users may “retweet” the original message, rapidly propagating a story or announcement in a viral fashion. In addition to retweets, followers are notified of tweets originating from followed accounts, so anyone can “follow” their favorite companies or individuals and be immediately aware of their major announcements.

Beyond tweeting, retweeting, and following, Twitter also allows users to mention other users, which makes the Twitter platform more two-way than traditional news outlets, which are distinctly one-way in their flow of information (outlet to consumer). Companies often reply to “mentions” to clarify their position or take advantage of marketing opportunities.

Some very famous people capture tens of millions of followers, but it is not necessary to “follow” a Twitter account to see its publications, as long as the account is public. Even though a company account may only have 1 million followers, there may be millions more reading it. Moreover, it is not necessary to even have an account at all to read public tweets, implying even more people may be reading every announcement than it seems from the active user data.

Twitter users range from heads of state to industry leaders to your next door neighbor. Companies also maintain Twitter accounts, and the two-way communication channel means customers can publicly interact with companies, leaving a public record behind. Government agencies and departments also use Twitter, so the release of employment numbers or central bank decisions are announced through the service in addition to the agency’s own, government-based page. That means a single investor can simply monitor Twitter for major announcements instead of various websites and other publication channels (like print and television media).

Comparison to Other Social Media Platforms

Other major social media platforms that may deliver news include Facebook, LinkedIn, and Instagram. Facebook, with billions of profiles, clearly reaches more people than Twitter. However, posts on Facebook can be any length, so the succinctness of Twitter is lost on that platform. Instagram, with its focus on photography, can be extremely succinct, using only a single image as a post. But its layout and purpose do not lend themselves to news broadcast. LinkedIn can also feature news stories, but its main purpose is networking, and rapid, short updates are generally absent from the platform.

The 280 character limit is central to doctrine of succinctness in news. This means when a story is breaking, trusted and popular news sources can make fast, visible updates without posting a story with only a couple lines. When readers see a breaking-news article only has three lines, they tend to have a negative reaction – it isn’t a fully developed news story yet, and as such, it does not warrant a full article. Twitter posts, however, are short and designed for such updates.

Moreover, Twitter’s character limit forces accounts to post only the most important data. While “threads”, or chains of connected tweets, do occur, accounts that post densely codified information into a single tweet are elegant. Writing out long posts is better on other platforms. Twitter’s succinctness lends itself to short updates and only the most important information being relayed. In finance, more price action can be captured if important information is incorporated earlier. Twitter provides a public and suitable platform for this very concept.

One final comparison to other services is Twitter’s direct integration with Google’s front page. Searching for any Twitter account will yield a Google search page with the latest tweets directly on the page. Other social media platforms are not integrated in this way, so it adds a layer of convenience to anyone researching a company or leader. Of course, the Twitter account’s history is important, but having the latest tweets on the front page of the world’s largest search engine is helpful.

The Rise of Twitter

Before the internet, there could be a significant lag time between the unfolding of an event and the public’s awareness of it. Other than the people on the ground at the scene, anyone not connected directly to the story would not be aware of it until it was made public through traditional publication channels.

With the advent of the internet, information could spread more quickly. But it wasn’t until social media became popular and certain services came to dominate the field that information was centralized and made available immediately to anyone with an internet connection. Twitter’s advantages of succinctness and immediate updates made it popular among news channels trying to beat the competitor to the story.

Newsworthy Developments

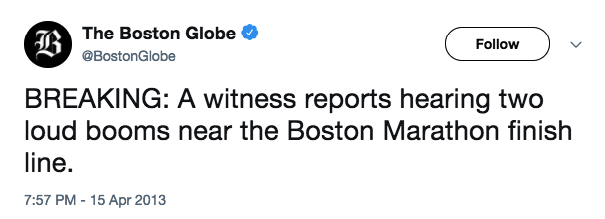

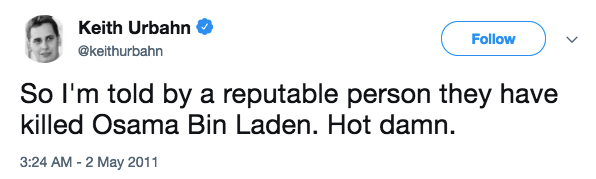

The first to break the story often gets the credit. But with Twitter, civilians were breaking stories before journalists even knew about them. As people became accustomed to immediate lines of communication between news stories, they started to turn to services like Twitter (and other social media platforms like Facebook) to receive news from other individuals right from the start. Viral tweets, retweeted and mentioned by thousands, quickly spread the first few minutes of a story before traditional media could write articles or get to the scene. Even more powerful, perhaps, was the first-hand accounts and real-time updates, with video and pictures of the event streaming in from our fellow humans on the ground.

One of the biggest news stories to break on Twitter was the Boston Marathon Bombing. Because people were at the scene, it was almost immediately known that explosions occurred at the event. What exactly occurred would take a bit longer to find out, but public awareness of something happening was nearly instant. Another story led by Twitter was the successful assassination of Osama bin Laden.

Entire movements have been sparked by Twitter and fueled by it and other social media – this was especially relevant during the Arab Spring, which saw some governments cutting off access to social media to prevent the spread of activism. Today, the powers that be also recognize the importance of social media, taking steps to prevent such uprisings again.

Company Announcements are Also Newsworthy

Whether you are investing in tech, utilities, or any other sector, it’s likely most of the companies in your portfolio maintain some sort of social media presence. Twitter’s platform, as stated above, is highly suitable to short announcements like important earnings numbers or merger and acquisition information. Twitter’s network effect – its position as a main player means people gravitate towards it, creating a stronger network, which in turn attracts more people, ad infinitum – means the most important points of contact, like company PR teams and industry leaders, are already publishing on Twitter.

Even in 2013 Twitter was a major source for investment news. The network effect has only served to cement Twitter’s position as a source for news and important information in mid-2018 (and this will likely continue to be true beyond this decade). One of the most beneficial aspects of following corporate and economic news on Twitter is the firsthand accounts. Large media organizations may have latent biases, so investors can receive information directly from the company as well as externally. This dichotomy means investors can see both points of view of a situation before investing (the company’s and the analysts’/media’s).

AI and Its Implications

Twitter is a goldmine of information for data mining. There are literally billions of tweets to use as data points. Of course, the tech sector is interested in capitalizing on this plethora of information. Research is being conducted to understand whether Twitter sentiment can predict stock market behavior.

An interesting example would be unconnected people tweeting about how their consumables taste bad. This could be a sign of an impending food recall affecting the stock price of a major food supplier. In a way, Twitter may be used to predict the future. Anyone with the data that thousands of people complain about a product can easily see the company will be affected. The data is there and current. The only problem is we haven’t been able to directly harness it – or at least the general public hasn’t been able to. Omniscience certainly leads to power, and a direct connection to millions of lives borders on social omniscience.

The Community

Self-coalescing Networks

Social media enables people to organize into groups nearly frictionlessly. Groups of traders and investors have come together to form self-administered groups tracking all sorts of events, from stock picks to price action. Some groups predate social media, and others have arisen solely based on social media APIs.

As people come together, they can influence the market. As more people join these self-created communities, their information becomes more heavily weighted in stock pricing. For example, a prolific group might tweet about a lesser-known stock that recently witnessed interesting price action; suddenly, hundreds or even thousands of traders are looking at the action, possibly further influencing the price as they try to enter or short the stock.

These self-coalescing communities also even the playing field. While brokerages and investment banks can pay millions of dollars in salaries and to capture information, the retail investor cannot. That means services and groups that publicly and rapidly disseminate important information on Twitter gives retail investors higher-quality access to crucial information than simply waiting for it to be published in more traditional news channels.

Investors and Chartists

Some of the networks are groups of individuals, while others are popular single individuals. Termed influencers in the marketing sphere, these individuals are followed by a large number of people. Before Twitter and social media, only those lucky enough to work their way onto TV or print media were able to become influencers. Today, anyone who has the time and skill to provide above-average advice can become an influencer.

Some influencers are already famous, like Warren Buffett. Twitter provides a direct link to Buffett’s mind for the retail investor. But Buffett is not the only investor with influence, and for those uninterested in value investing, Buffett may not be the best person to follow on Twitter. Daytraders will prefer those with similar timeframes, and bond investors will be interested in following accounts focused on bonds.

Twitter allows these influencers to both propagate their ideas as well as respond to the public at large (if they feel they want to). The two-way communication channel fosters mutual respect and trust, whereas the one-way channel of traditional media fosters distrust and a perception of bias.

Executives and Board Members

While companies maintain their own Twitter accounts, the people in those organizations may also have their own Twitter accounts. Executives will often assume their role as CEO or CFO or whatever other position they hold on their public accounts (they may assume their non-leader role on private accounts).

When executives do assume their leadership roles on Twitter, what they tweet may be insight into the company’s direction. It may also be commentary on political or social issues affecting their businesses, or it may be announcements of personal pride in their companies’ achievements. Following these accounts could provide insight that is otherwise unpublished for the general public.

Politics

Of course, government organizations have their own channels to publish information, but Twitter acts as an excellent platform to easily reach millions. Heads of state and other national leaders have leveraged the power of Twitter to broadcast their opinions. The most notorious among them is the US President, Donald Trump. Snubbing traditional political etiquette, Trump often blasts out his opinions to the world. Those tweets often have impacts on the market, which tend to manifest within a few minutes of the tweet.

Less fiery figures, like the European Central Bank or International Monetary Fund also have Twitter accounts, and their tweets are important sources of information. The short-message style of the platform coupled with the hashtag search mechanism enables investors to more easily find relevant information than some of the full-publication searches directly on the government websites.

Broader Community

The broader investment community also comes together on Twitter. While many accounts may only watch Twitter and not generate content, the greater the involvement of the community, the more efficient markets become. With the rapid propagation of information on Twitter, retail investors are no longer left behind when important news becomes known. The investment banks and brokerage houses may still get early warning directly from the source, but that early warning starts to become legally precarious, as such early warning starts to border on insider trading.

On a more positive note, the community can communicate openly and easily, without fear of filtration by gatekeepers. They can share ideas unhindered, leading to potential grassroots innovation and a fairer marketplace. After all, individuals make up companies and they make up the market, so why shouldn’t the retail investor be privy to the same information as an elite investment banker? Sometimes those investment bankers are even the ones leaking the information on Twitter.

Risks, Problems, and Solutions

Of course, this wide-open power to broadcast information across the globe instantly also carries risks. Information may be inaccurate (both purposefully and accidentally), major influencers might sway markets to create self-gains, and the sheer volume of information generated every second on Twitter (not to mention other platforms) is simply unmanageable for any individual that reads at less than 10,000 words per minute (which means anyone lacking the assistance of AI).

Violation of Confidentiality

The first risk follows from information leakage. The line between confidential and public information can sometimes be hazy, and if employees are accustomed to tweeting information about themselves, they may accidentally broadcast confidential information to the world. This might be information regarding M&A activity or earnings results. It could be material information regarding pending lawsuits.

As the Internet and social media in particular continues to pervade our lives, accidents will likely occur where an employee privy to important confidential information may leak it via Twitter. The broadcast nature of the platform is where the danger lies, because once the information is released, it is no longer containable. It will spread virally, and there is no way to protect against this release of information. Only the lucky few who caught the Tweet early will be able to capture price action from it.

Influencers and Self-gains

Donald Trump is probably the most powerful person to regularly tweet important information that affects markets and the world in general. Not all people have such powerful effects via Twitter, but executives or even low-level employees with contrarian and confidential information may be able to “game the system”. If an executive tweets negatively about a pending lawsuit, the stock price could fall. That may even be the work of trading bots that comb Twitter, searching for actionable information, not humans reacting to market news.

Companies, think tanks, and news organizations with broad appeal could also influence markets. Individual chartists or investors may also be able to sway markets if they have significant followings, or at least are deemed significant enough by bots. Gaming the system is certainly a risk for the market as a whole, because once the misleading information is identified as false, prices will snap back to pre-tweet levels, leaving some investors and traders with major realized losses.

Noise – and a Lot of It

The most pressing issue for the retail investor is noise. Cutting out noise from personal accounts is relatively easy. However, cutting out the noise from tens or hundreds of accounts that one wishes to follow is much more difficult.

For example, say you are trading Barclay’s stock. Of course you would want to follow Barclay’s and some of the top management. Banking industry organizations might also be a good idea. National and international banking regulatory agencies might also be useful. But what about Barclay’s competitors? If a European bank tweets about pulling out of the UK after Brexit, that will affect Barclay’s stock price. Or if a counterparty to Barclay’s files for bankruptcy, leaving Barclay’s with millions in losses, you would want to know about it.

For the hugely influential financial sector, perhaps just a few Twitter accounts would suffice. What about for less information-rich sectors, like biotech? You need to watch competitors very closely, because any announcement of a breakthrough could cause prices to fall precipitously for competing firms. These industries have fewer centralized information depots, meaning the retail investor must pay more attention to each account.

There is also the question of fake news or inaccurate information. Anyone can post anything on Twitter. That extreme freedom has the very positive upsides of giving voices to the oppressed (including whistleblowers), but it also has the very negative downside of malicious actors posting intentionally false news. If someone were to hack the Twitter account of a company, they could easily tweet harmful but believable things, causing prices to drop. Those actors would likely act on that drop, but investors wouldn’t know the outcome until it was too late.

Another concern is simply inaccuracies and rampant speculation. The Boston bombing incident was relatively contained in a small space, but apparently only 20% of the tweets sent were factual. For far more complex situations, like acts of war in Syria, only organizations and time can give accurate depictions of a widespread, tangled, and complex event. However, Twitter is full of individuals, each with the power to make their own false conclusions based on partial or biased evidence. Therefore, it is imperative for the investor to find a balance between using Twitter to react swiftly but simultaneously retaining sanity and accuracy.

Top Financial News Twitter Accounts

Top 30 Financial Influencers

Mike Patel

Founder - http://LXMI.IO #Entrepreneur#Cryptoeconomics #AutomatedTrading#LinguisticData#AsymmetricTrends#Blockchain #GannTheory#Consciousness

Graeme Dixon

CEO @octopusintell, the global Competitive Intelligence Agency. #cufc#nffc #shorinkan Digging around answering questions @octopusforsupporter.

Tony Rocha

Radio & TV Director, Communication's Ph.D, Entrepreneur. Brands/Celebrities/Athletes/Models #SMConsultant.

Carl Icahn

Chairman of Icahn Enterprises L.P.; etc., etc. Some people get rich studying artificial intelligence. Me, I make money studying natural stupidity.

Justin Sun

Founder of @tronfoundation丨@ForbesAsia 30 Under 30丨the First Millennial Graduate of Hupan University Founded By Jack Ma From @alibabagroup #TRON#TRX $TRX

Jim Cramer

I am founder of @TheStreet & I run charitable trust portfolio Action Alerts PLUS. I also host @MadMoneyOnCNBC& blog daily on http://RealMoney.com . Booyah!

Jeff Sheehan- Influencer | Author | Speaker

#ATL #SocialSelling #Marketing Pro #Speaker #Author #Podcaster#Toastmaster Luv Travel |Photog | 13.1

Tim O'Reilly

Founder and CEO, O'Reilly Media. Watching the alpha geeks, sharing their stories, helping the future unfold.

Sheff

Biotech, Portf Mngr, SwingTrader/Investor, Kids Cancer Hero, Chemopal, Hubby/Dad. Dear Cancer: https://youtu.be/05KpWq8VjzA @vipshefftrades4 CCA contributors $

Jeremy Kaplan

Editor in chief @DigitalTrends. Brooklynite. As Editor-in-Chief of Digital Trends, one of the world's largest technology publishers, I run the editorial staff both creatively and operationally.

Peter Olsen

Global Internet Entrepreneur Living the Laptop Lifestyle!

Jeffrey Gundlach

Bills fan. Art fan. Truth fan. DoubleLine CEO.

Ian Bremmer

political scientist, author, prof at nyu, columnist at time, president @eurasiagroup, @gzeromedia. if you lived here, you'd be home now.

Ben Bernanke

Author of The Courage to Act, now available in paperback: http://bit.ly/1KOmnxd . Former Fed Chair; Distinguished Fellow in Residence, @BrookingsInst.

Mohamed El-Erian

Chief Economic Adviser, Allianz. Author of NYT bestsellers "When Markets Collide" and “The Only Game in Town.”

Aswath Damodaran

Fascinated by finance & markets, like writing about them and love teaching even more.

Josh Brown

Chairman of the Twitter Federal Reserve, CNBC Contributor (The Halftime Report), CEO of Ritholtz Wealth Management

Mark Cuban

#DallasStrong. insta:mcuban snap:mcuban DustMessaging: blogmaverick everything else http://markcuban.com

Joshuwa Roomsburg

Blockchain Digital Marketing Advisor (Owner @JaxonMarketing) @HelexCorp@TracoinOfficial @Jetcoins @BeatToken@TradeToken @Hurify_HUR@SavedroidAG

Mike Magolnick

CEO of The Magolnick Media Company | #SocialMedia, #Cryptocurrency & #Blockchain Thought Leader | 4x Bestselling #Author | #DanceDad#NavyDad

C. Michael Gibson MD

Non-Profit Founder/Leader | Doc | Artist | Scientist | Educator | Med News Anchor http://wikidoc.org | RT ≠ endorse | Disclaimer here: http://bit.ly/1mewZOF

Money Saving Expert

Founded by @MartinSLewis dedicated to cutting your costs, finding deals, beating the system & fighting your corner. RTs aren't endorsements.

OM

I was a reporter once. Now I have opinions about tech. I write. I make photos. I invest @TrueVentures & blog at http://om.co.

Ben Carlson

Trying to bring some common sense to the world of finance. Book: http://amzn.to/1FmQOXf Podcast: http://awealthofcommonsense.com/podcast/

Ramit Sethi

CEO & author of New York Times bestseller, I Will Teach You To Be Rich. 1 million readers on business, money, careers, psychology. http://Instagram.com/ramit

Austan Goolsbee

Econ prof at U.Chicago's Booth School of Business and former Chairman of the Council of Economic Advisers. Strategic partner, @32Advisors

Mr. Money Mustache

Mr. Money Mustache was a thirtysomething retiree who now writes about how we can all lead a frugal yet Badass life of leisure.

Downtown Josh Brown

Chairman of the Twitter Federal Reserve, CNBC Contributor (The Halftime Report), CEO of Ritholtz Wealth Management

Zeynep Tufekci

Thinking about our tools, ourselves. @UNCSILS prof + @NYTimes writer.

Wise Bread

Personal Finance and Frugal Living Portal. Tweets by Ashley Jacobs (@CollegeCents).

Top 30 Financial and Business Publications

Financial Times

The best of FT journalism, including breaking news and insight.

Financial Times

Financial Times headlines as they’re published on http://FT.com.

TechCrunch

Breaking technology news, analysis, and opinions from TechCrunch. Home to Disrupt, TC Sessions, and Startup Battlefield. Got a tip? tips@techcrunch.com

Guardian News

Latest US news, world news, sports, business, opinion, analysis and reviews from the Guardian, the world's leading liberal voice.

MarketWatch

News, personal finance & commentary from MarketWatch.

Bloomberg Markets

Breaking news and analysis on global financial markets.

BBC News (World)

News, features and analysis from the World's newsroom. Breaking news, follow @BBCBreaking. UK news, @BBCNews. Latest sports news @BBCSport

BBC Business

Business news from the BBC. This is our official account aimed at a UK audience. For more global BBC business news please follow @BBCWorldBiz.

Reuters Business

Top business news around the world. Join us @Reuters, @breakingviews, @ReutersGMF

Forbes Tech News

Tech news and insights from @Forbes. Producer: @HellaSamar

CNBC Now

CNBC is First in Business Worldwide. Follow @CNBCnow for breaking news, real-time market updates & more from CNBC's breaking news desk.

Cboe

One of the world’s largest exchange holding companies, #poweringpotentialto stay ahead of an evolving market with cutting-edge trading and investment solutions

Bloomberg TV

Breaking news. Exclusive interviews. Market-moving scoops. Watch Bloomberg #Daybreak LIVE on @Twitter, every weekday from 7:00 - 9:00 AM ET.

Nasdaq

At Nasdaq, we're relentlessly reimagining the markets of today. Not by chasing the possibilities of tomorrow, but by creating them.

The Economist

Official posts from The Economist on Business, Finance and Economics.

NC2

ICO CRYPTO NEWS

GFM Review

GFM Review is a global online financial portal which aggregates news from Tier1 providers and brings it to one location for ease of use and an unbiased view

The New York Times

Where the conversation begins. Follow for breaking news, special reports, RTs of our journalists and more.

TNW (The Next Web)

Your source for opinionated perspectives on tech news for Generation T

NYTimes Tech

Tech news and analysis from The New York Times. Banner photo by Jason Henry.

The Wall Street Journal

Breaking news and features from the WSJ.

Bloomberg LP

Connecting decision makers to a dynamic network of information, people and ideas.

Guardian Tech

News and comment from the @Guardian's technology team

BBC Technology

The official account for the BBC News technology team.

Breaking News

NBC Breaking News around the world

Techmeme

The essential tech news of the moment. Technology's news site of record. Not for dummies.

BBC Breaking News

Breaking news alerts and updates from the BBC.

BBC News (UK)

News, features and analysis.

Summary

If you want to react in a timely manner, keeping track of Twitter feeds is important. So how can you resolve the noise issue? One way is to use search when looking for various topics. The hashtag symbol (#) is the main way people self-categorize their tweets. An interesting tag for stocks is the use of the dollar symbol ($) for business-related tweets.

Another great way is to use CityFALCON's API (in conjunction with your own Twitter license). Our services are specifically designed for information aggregation, and we focus on helping you sift through large quantities of data, including Twitter feeds, to find the most relevant information. Unless you have your own AI or your own team of curators, you will need some help.